The insurance industry has long operated on a foundation of paperwork, adjusters, and lengthy claims processes. But a quiet revolution is unfolding in boardrooms from Zurich to Singapore, one that could fundamentally change how businesses and communities recover from catastrophes. Parametric insurance—once a niche product for agricultural and energy sectors—is now emerging as a game-changer for everything from hurricane protection to pandemic business interruption.

Unlike traditional insurance that pays based on assessed losses, parametric policies trigger automatically when specific, pre-defined conditions are met. Think of it as insurance that operates like a thermometer: when the temperature hits a certain point, or when earthquake sensors detect specific shaking intensity, payments are made without waiting for damage assessments. This isn't just convenient—it's transformative for cash-strapped businesses facing immediate recovery needs.

What's driving this shift isn't just technological innovation but growing frustration with traditional insurance's limitations. After Hurricane Katrina, businesses waited an average of 90 days for claim settlements. During COVID-19, many business interruption claims became mired in coverage disputes. Parametric solutions cut through this complexity by removing subjectivity from the equation entirely.

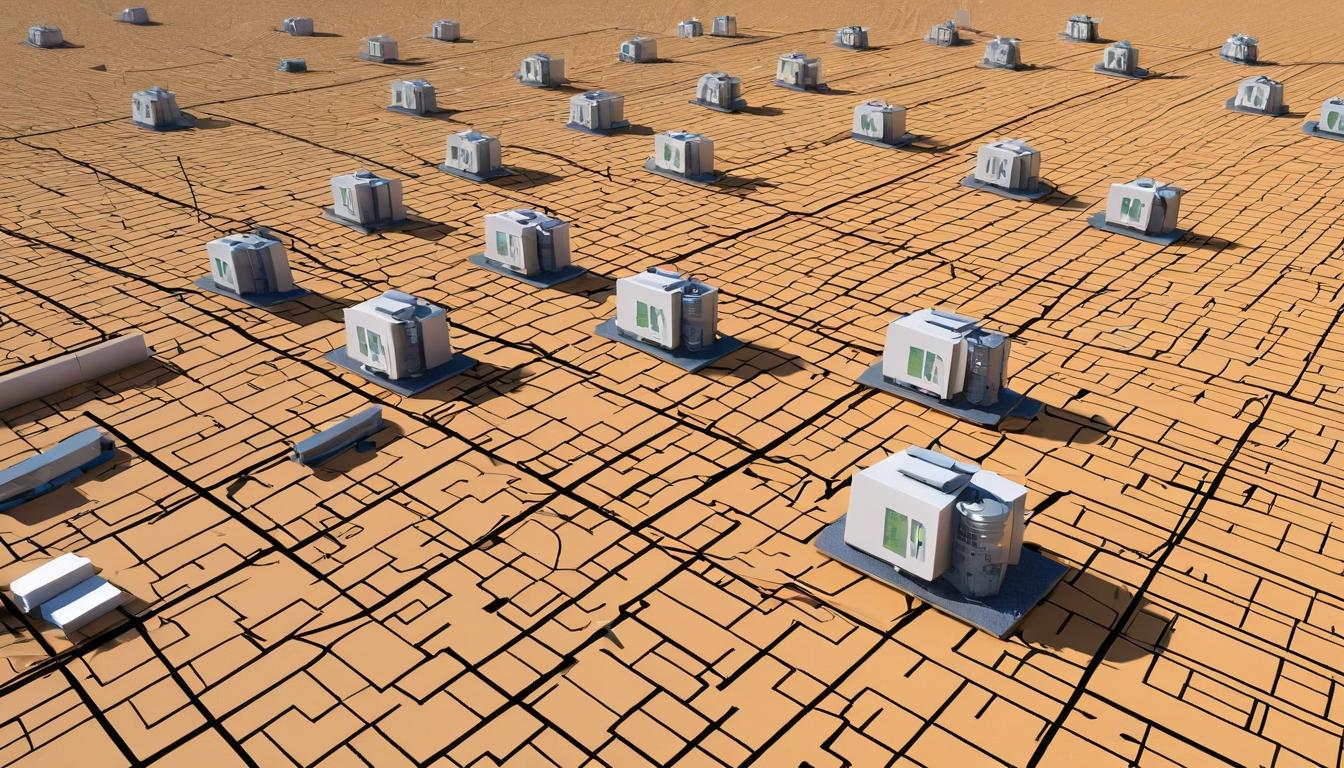

The technology enabling this revolution reads like something from a science fiction novel. Satellite imagery monitors crop health down to individual fields. Seismic sensors deployed across fault lines provide real-time earthquake data. Ocean buoys measure wave height and storm surge with precision previously unimaginable. This infrastructure creates the trusted data sources that make parametric triggers both reliable and auditable.

For developing nations, parametric insurance isn't just convenient—it's potentially life-saving. The Caribbean Catastrophe Risk Insurance Facility, established in 2007, provides immediate liquidity to member governments following hurricanes or earthquakes. When Hurricane Dorian struck the Bahamas in 2019, the facility paid out $10.8 million within two weeks—critical funds that helped launch recovery efforts while traditional aid was still being organized.

But the expansion into new domains brings fresh challenges. Cyber risk, for example, presents fascinating parametric possibilities but also complex measurement questions. How does one objectively quantify a data breach's impact? Some innovators are developing triggers based on system downtime or number of records compromised, but these metrics only capture part of the story.

The human element remains both parametric insurance's greatest strength and its most significant limitation. While automated payouts provide speed, they can't account for nuances that human adjusters might catch. A policy might trigger for a Category 3 hurricane making landfall, but what if the storm hits a sparsely populated area? The insured receives payment regardless of actual losses—efficient perhaps, but potentially problematic for moral hazard.

Regulators are watching this space with intense interest. The Commodity Futures Trading Commission recently approved the first parametric catastrophe risk futures contracts, effectively creating a traded market for insurance risk. This development could dramatically increase capacity for parametric coverage while introducing new complexities around risk modeling and transparency.

For insurance brokers, parametric products represent both opportunity and disruption. The sales process shifts from explaining coverage terms to educating clients about data sources and trigger mechanisms. This requires a new breed of insurance professional—one comfortable with data science and technology as much as policy wording.

Looking ahead, the convergence of parametric insurance with blockchain and smart contracts suggests even more radical transformation. Imagine insurance policies that automatically pay claims through self-executing code, with payments flowing directly to predetermined bank accounts within hours of a qualifying event. The potential for efficiency is staggering, though the regulatory and operational hurdles remain significant.

The silent revolution continues to gain momentum, driven by climate change, technological advancement, and growing impatience with traditional insurance's pace. As one reinsurance executive recently told me, 'We're not just selling policies anymore—we're designing financial instruments that respond to the real world in real time.' For businesses and communities facing increasingly volatile risks, that responsiveness might make all the difference.

The silent revolution: how parametric insurance is reshaping disaster recovery